puerto rico tax break

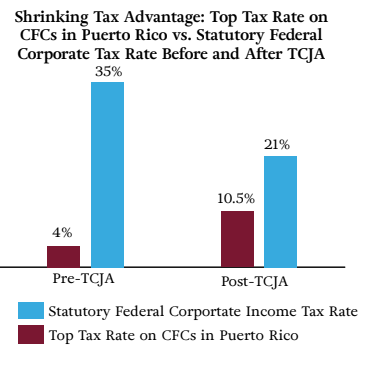

Also known as the Possession Tax Credit Section 936 was a provision in our tax code enacted in 1976 ostensibly to encourage business investment in Puerto Rico and other US. 1 the 4 corporate tax rate has existed for decades and lasts potentially decades into the future.

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

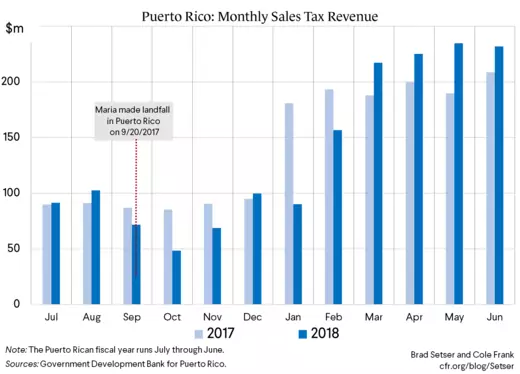

In 2006 the.

. Territory also has crypto-friendly policies including huge tax breaks to those who spend. Relative to the Made-In-America tax break the Made-in-Puerto Rico tax break has significant advantages. IRS code and because the per-capita income in Puerto Rico is much lower than the average per-capita income of the US states more Puerto Rico residents pay income taxes to the local taxation authority than if the IRS code were applied to the island.

The Made-In-Puerto Rico tax break results in a total corporate tax rate of 4. If you stay in Puerto Rico for 19 years and Act 60 sticks around youll get the 0 rate on 50 of your gain. It gives owners of incented new Puerto Rican companies a 34 tax on dividended income.

Beyond the fact that Puerto Rico offers a year-round tropical backdrop with picturesque beaches the US. If youre a bona fide resident and have to file a US. The zero tax rate covers both short-term and long-term capital gains.

Read more about Puerto Rico taxes and how to qualify for these tax breaks in Part One of our Puerto Rico tax series. Puerto Rico has a de minimis rule to avoid sourcing to Puerto Rico very small amounts of. Any time a new tax reduction strategy comes along you can bet the sharks will start circling looking for weaknesses and ways to make things easier.

The answer to that question depends a lot on how much money you make. For the right business and if set up properly this can lead to significant tax savings. Income taxation doesnt apply to amounts you receive for services performed as an employee of the United States or any agency thereof.

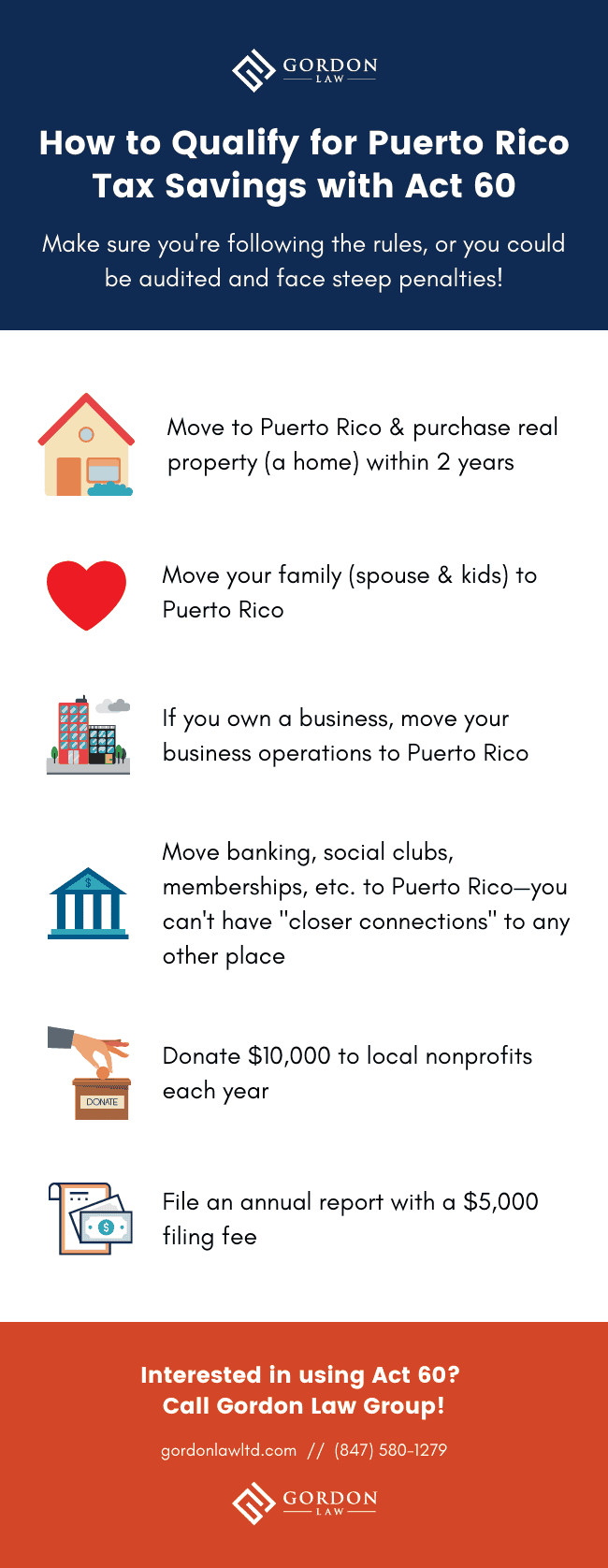

The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as. Cryptocurrency traders hedge-fund managers and wealthy individuals have been exiting the mainland to Puerto Rico to avoid President Bidens proposed increases on capital-gains tax. Paul is not alone.

Super-Rich Headed to Puerto Rico With an Eye on Tax Breaks Jun 8 2021 Blog Because Puerto Rico offers substantial tax advantages a new trend has begun. Act 20 is for companies. Legally avoiding the 37 federal rate and the 133 California or other state rate sounds pretty good.

Puerto Rican non-residents are only taxed in Puerto Rico on their Puerto Rico-source income. In 2019 the Puerto Rican government combined these laws and renamed them Act 60. As the cutoff point for income taxation in Puerto Rico is lower than that imposed by the US.

Rodriguez for The New York Times. Avoiding what he sees as unnecessarily high taxes in the Golden State in favor of Puerto Ricos considerable tax breaks. If youre a bona fide resident of Puerto Rico youll be able to exclude income from Puerto Rican sources on your US.

Lots of Sharks in These Waters. However in general Puerto Rican taxes are considerably lower than US taxes. It confers a 100 tax holiday on passive income and capital gains for 20 years.

You have to pay yourself a normal base salary. You have to move to Puerto Rico to qualify. Still Puerto Rico hopes to lure American mainlanders with an income tax of only 4.

Income for services performed is sourced to Puerto Rico based on where the services are performed. For years the wealthy have swarmed to Puerto Rico to profit off of tax exemptions that dont extend to native Puerto Ricans and while the island is still in an economic crisis there are concerns that. And 2 the tax rate is for goods and services.

Meanwhile in the United States your first 10000 is taxed at 10. Act 22 is for individuals. However this exemption from US.

Companies that received the tax break. Such income is typically prorated to Puerto Rico based on workdays. In Puerto Rico the first 9000 is completely tax-free.

Known as Act 60 previously Acts 20 and 22 Americans who move a qualifying business to Puerto Rico including becoming a Bona Fide resident and establishing an office in Puerto Rico will pay just 4 corporation tax and no tax on capital gains dividends interest and royalties. Act 22 Puerto Rico Individual Investors Act which introduced zero tax on capital gains and passive investment income like dividends. This is great news for the working class.

Congress voted to phase out Section 936 in 1996 citing excessive cost and the very limited number of US.

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Puerto Rico Offers The Lowest Effective Corporate Income Tax

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Puerto Rico Luring Buyers With Tax Breaks The New York Times

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Tax Breaks For Crypto Millionaires Stir Outrage In Puerto Rico As Housing Surges Bloomberg

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Federal Covid 19 Emergency Paid Leave Rules Apply In Puerto Rico But With Unique Tax Aspects Ogletree Deakins

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Us Tax Filing And Advantages For Americans Living In Puerto Rico